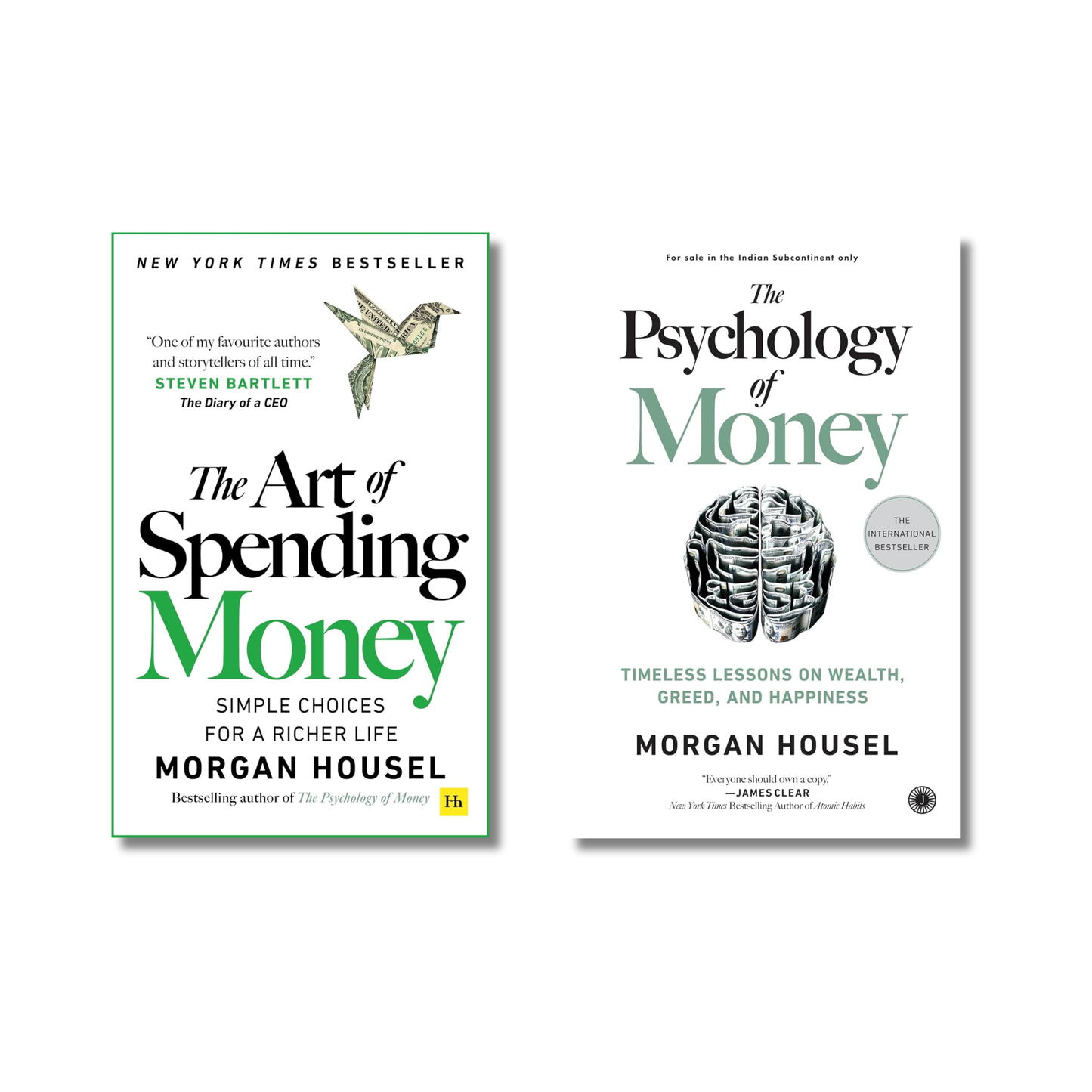

This powerful 2-book combo by bestselling author Morgan Housel gives readers a complete understanding of how money truly works — not in spreadsheets, but in real life.

If you want to build wealth, make smarter financial choices, and improve your relationship with money, this set delivers everything you need.

Book 1: The Psychology of Money

A globally celebrated bestseller that reveals the hidden behaviors, emotions, and biases that shape every financial decision we make.

Housel explains why being smart with money isn’t about IQ — it’s about self-control, long-term thinking, patience, and understanding human nature.

You’ll learn:

-

Why people make irrational financial choices

-

How luck, risk, and timing affect wealth

-

The importance of saving even when you don’t have a goal

-

Why long-term consistency beats short-term brilliance

This is not a technical finance book — it’s a guide to thinking better about money.

Book 2: The Art of Spending Money

This book focuses on what most people ignore: how to use money in a way that actually improves life.

Housel breaks down the psychology of spending and teaches how simple choices can create a richer, more meaningful lifestyle — without chasing endless consumption.

You’ll learn:

-

How small spending habits impact long-term happiness

-

Why most people buy things for the wrong reasons

-

The art of spending in alignment with your values

-

How to avoid emotional, compulsive, or status-driven spending

This book helps readers shift from “earning money” to using money wisely.

| Format | Paperback |

| Language | English |